- Home

- YOUR FUTURE

- Futurist Keynotes

- FUTURE EVENTS

- How Patrick Dixon will transform your event as a Futurist speaker

- How world-class Conference Speakers always change lives

- Keynote Speaker: 20 tests before booking ANY keynote speaker

- How to Deliver World Class Virtual Events and Keynotes

- 50 reasons for Patrick Dixon to give a Futurist Keynote at your event

- Futurist Keynote Speaker - what is a Futurist? How do they work?

- Keys to Accurate Forecasting - Futurist Keynote Speaker with 25 year track record

- Reserve / protect date for your event / keynote booking today

- Technical setup for Futurist Keynotes / Lectures / Your Event

- Dr Patrick Dixon MBE

- Futurist Books

- 18 books by Futurist P Dixon

- How AI Will Change Your Life

- The Future of Almost Everything

- SustainAgility - Green Tech

- Building a Better Business

- Futurewise - Futurist MegaTrends

- Genetic Revolution - BioTech

- The Truth about Westminster

- The Truth about Drugs

- The Truth about AIDS

- Island of Bolay - BioTech novel

- The Rising Price of Love

- Clients

- CONTACT for KEYNOTES

Patrick Dixon - Futurist Keynote Speaker "How AI Will Change Your Life" - 18th book

25 Years Experience in Future Trends Forecasting >400 Global Clients - Every Industry and Region

Truth about AI and Sustainability - huge positive impact of AI on ESG UN goals, but energy consumed

AI will help a sustainable future - despite massive energy and water consumption. AI Keynote speaker

The TRUTH about AI. How AI will change your life - new AI book, beyond all the hype. Practical Guide

How AI Will Change Your Life: author, AI keynote speaker Patrick Dixon, Heathrow Airport WH Smiths

How AI will change your life - a Futurist's Guide to a Super-Smart World - Patrick Dixon is a Global Keynote Speaker on AI, Author of 18 BOOKS, Europe's Leading Futurist with 25 year track record advising large multinationals - CALL NOW +44 7768 511390

How AI Will Change Your Life - A Futurist's Guide to a Super-Smart World - Patrick Dixon signs books and talks about key messages - future of AI, how AI will change us all, how to respond to AI in business, personal life, government. CALL +44 7768 511390

Future of Sales and Marketing in 2030: physical audience of 800 + 300 virtual at hybrid event. Digital marketing / AI, location marketing. How to create MAGIC in new marketing campaigns. Future of Marketing Keynote Speaker

TRUST is the most important thing you sell. Even more TRUE for every business because of AI. How to BUILD TRUST, win market share, retain contracts, gain customers. Future logistics and supply chain management. Futurist Keynote Speaker

Future of Artificial intelligence - discussion on AI opportunities and Artificial Intelligence threats. From AI predictions to Artificial Intelligence control of our world. What is the risk of AI destroying our world? Truth about Artificial Intelligence

How to make virtual keynotes more real and engaging - how I appeared as an "avatar" on stage when I broke my ankle and could not fly to give opening keynote on innovation in aviation for. ZAL event in Hamburg

"I'm doing a new book" - 60 seconds to make you smile. Most people care about making a difference, achieving great things, in a great team but are not interested in growth targets. Over 270,000 views of full leadership keynote for over 4000 executives

SECRET of MOTIVATION and INSPIRATION!! Make things happen faster. #shorts

TRUST is THE most important thing you sell. Lessons for all leaders: business and government #Shorts

Quiet Quitters are 50% of US workforce - checked out emotionally. Connect with your Purpose! #Shorts

Futurist Keynote Speakers - how Futurist Keynotes transform events, change thinking, enlarge vision, sharpen strategic thinking, identify opportunities and risks. Patrick Dixon is one of the world's best known Futurist Keynote Speaker

Futurist Keynote Speaker: Colonies on Mars, space travel and how digital / Artificial Intelligence / AI will help us live decades longer - comment before Futurist keynote for 1400 at Avnet Silica event. Futurist Keynote Speaker on AI

Future of Travel and Tourism post COVID. Boom for live experiences beyond AI. What hunger for "experience" means for future aviation, airlines, hotels, restaurants, concerts halls, trends in leisure events, theme parks. Travel Industry Keynote Speaker

Quiet Quitters: 50% US workforce wish they were working elsewhere. How engage Quiet Quitters and transform to highly engaged team members. Why AI / Artificial Intelligence is not answer. How to tackle the Great Resignation. Human Resources Keynote Speaker

The Great Resignation. 50% of US workers are Quiet Quitters. They have left in their hearts, don't believe any longer in your strategy. 40% want to leave in 12 months. Connect with PURPOSE to win Quiet Quitters. Human Resources Keynote Speaker

Future of Human Resources. Virtual working, motivating hybrid teams, management, future of motivation and career development. How to develop high performance teams. HR Keynote Speaker

Future Growth of Emerging Markets / India / China - keynote speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Future of Emerging Markets - where 85% of the world now lives. Patrick Dixon is one of the world's best-known Futurist keynote speakers, has worked with hundreds of the world's largest companies and has been ranked one of the 20 most influential business thinkers alive today. Futurist articles / videos and keynote conference presentations on emerging markets - opportunities for multinationals to enlarge sales, and buy products or services at lower prices, including outsourcing and offshoring, impact of AI / Artificial Intelligence on jobs in emerging markets. Patrick Dixon has worked with hundreds of the world's largest multinationals including Google, Microsoft, General Motors, General Electric, Unilever, ExxonMobil, Siemens, DHL, Fedex, Vodafone, HSBC, Aviva, Prudential, Phillips, Nokia, Tetrapak, BP, Air France and the World Bank.

Patrick Dixon has given Futurist keynote presentations on a wide range of issues in Central America, Latin America, Central Europe, Eastern Europe, Baltic States, Middle East, Africa, Central Asia and South East Asia. Countries include Barbados, Belarus, Brazil, Burundi, China, Czech Republic, Democratic Republic of Congo, Egypt, Estonia, Fiji, Estonia, Hungary, India, Kazakhstan, Latvia, Malaysia, Mexico, Morocco, Nigeria, Panama, Poland, Romania, Russia, Saudi Arabia, Singapore, Slovakia, Slovenia, South Africa, Thailand, Turkey, Ukraine, Uganda, United Arab Emirates and Zimbabwe.

Emerging markets will drive global economic growth for next 60 years - where 85% of humanity lives. Global Economy and Macrotrends Keynote Speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Economic and social trends will be dominated by emerging markets. Extract from keynote for Seminarium in Chile. Article below posted April 2021 - you can judge accuracy.1. Global economy survived the first and second crises better than many thought would be the case. Thanks to emerging markets, the global economy grew in every year of the banking crisis except 2009. Growth in China slowed but never below 5-7% a year. And a year after COVID lockdowns first began, US stock markets had largely recovered, while many global companies had excellent cash reserves, ready for investing in growth. Of course, part of that was because of levels of Central Bank and government support that one would normally only see in wartime. For example, a year after Lockdown began, the UK government was still paying the salaries of around 25% of all privately employed workers. 2. Publicly listed corporations around the world are sitting on over $12 trillion cash reserves (excluding financial companies) That’s more than the entire foreign exchenge reserves of all naitons. Expect large-scale investment over the next 5‒10 years....

* "How AI Will Change your life - A Futurist's Guide to a Super-Smart World" - Patrick Dixon's latest book on AI is published in September 2024 by Profile Books. It contains 38 chapters on the impact of AI across different industries, government and our wider world, including chapters on the future impact of AI on emerging market economies and jobs.

Shocking facts about your future - how 11 billion people will eat, sleep and breathe in our future world where 1% owns 65% of the wealth, 85% live in emerging markets, with new people movements and revolutionary forces. Futurist keynote speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Unsustainable population growth

One billion children will become consumers in the next 15 years – the biggest jump in human history.

Today in

Africa 350 million children see glimpses of your lifestyle and compare this to

their own, surviving on less than $3 a day. Most of them will spend their

entire adult lives living in cities, chasing dreams of wealth.

By 2025, most people on the planet will be in Asia.

85% of the world’s population will be living in emerging markets or today’s developing countries by then, mostly in cities.

Only 1 in 7 will be in today’s developed nations, driving less than 10% of the world’s economic growth.

Future of China - 300 year trend that will shake the entire world. Truth about so-called "emerging markets" and future risks for China - Futurist keynote

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

China is a wealthy ‘nation of nations’ with a huge middle class, gigantic manufacturing capacity, its own dotcom boom, the world’s largest high-speed rail network, and one of the best educated workforces in the world. China is evolving rapidly and for many globalised corporations manufacturing in China is becoming a rather old-fashioned idea, because of rising costs.

China is now the world’s largest economy according to the World Bank, on the measure of purchasing power parity (PPP), which looks at what the local currency will actually buy, after adjusting for international exchange rates. China’s economy will be three times the size of India’s in 2025, as it is today, but we can expect that India will close that gap in the longer term.

On an absolute dollar basis, China will be the world’s largest economy by 2024, propelled by a threefold rise in consumer spending each year from $3.5 trillion in 2014 to $10.5 trillion by 2024. This will all be part of a transition from an export-led, manufacturing economy to a more balanced economy serving Chinese consumers.

What Future for Saudi Arabia? Keys to competitiveness, investment, innovation, education, diversify economy - Saudi Arabia keynote

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Future of Saudi Arabia - keynote at Global Competitiveness Forum (GCF 2015) organised by SAGIA. Comments by Patrick Dixon, Chairman Global Change Ltd, following keynote at the Riyadh event.

With a young and rapidly growing population, a key government objective is to create several million new jobs over the next few years, for nationals rather than for migrant workers. Indeed the future well-being of the nation may depend on being able to generate enough new jobs, particularly for those from 18-30 years old. While national policies have been developed to encourage companies to employ local people, Saudi Arabia is also looking to stimulate growth of local business and encourage inward investment. Need a world-class keynote speaker on competitiveness in the Middle East for your event? Phone or e-mail Patrick Dixon now.

Future of Russia - comments in 2018 on Moscow trip: economy, innovation, business, culture, Russian history, foreign policy, military spending and global influence. Why media forecasts on Russia are often wrong, why travel so important. VIDEO and POST

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Comments after trip to Moscow (2018), after giving keynote on digital innovation at a big event. Russia is a vibrant nation, with many contrasts across 11 time zones. Nation is being energised by a new generation of highly talented entrepreneurs who have no memory of life under Communism, and who are very similar in many ways in their attitudes to the same generation in Western Europe. Media coverage in Western nations can be very misleading and superficial. There's no substitute for actually visiting a nation, talking to people. Impact of recent events on Russia economy, innovation, business, foreign policy or military spending. Government stimulus of the Russian economy - why this will be difficult to achieve rapidly. Why history is so important in understanding future of Russia, including the impact of the Second World War on Russian psyche and current fears, and of course the fall of the Iron Curtain.Future Reform of State-Owned Enterprises in emerging markets

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

One of the greatest challenges facing emerging markets like China and Vietnam is what to do about State-Owned Enterprises, or nationally owned industries. There are 145,000 of them in China alone. They generate 35% of China’s GDP and 43% of profits. Many of them survive only with large government subsidies, which distort national markets. They may enjoy lower tax rates than privately owned competitors. They often rely on huge bank loans at preferential rates of interest, crowding out other borrowers, discouraging investment and adding to government liabilities. So what should be done?

Read more: Future Reform of State-Owned Enterprises in emerging markets

Vietnam - faster growth than some other parts of Asia

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Labour costs are only half that in China, for same job in same kind of factory. But that only makes sense if productivity is half, which is unlikely, especially in any newly built manufacturing base.

Expect therefore that the investments will continue – although it may be a challenge to consistently top more than $10bn a year, as has been the case recently, because there are even cheaper destinations such as Myanmar that are opening up.Vietnam – time to catch up with rest of Asia.

Read more: Vietnam - faster growth than some other parts of Asia

Growth of Asia Exports – Vietnam Leads Emerging Markets. Future of Emerging Markets and Global Economy Keynote Speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

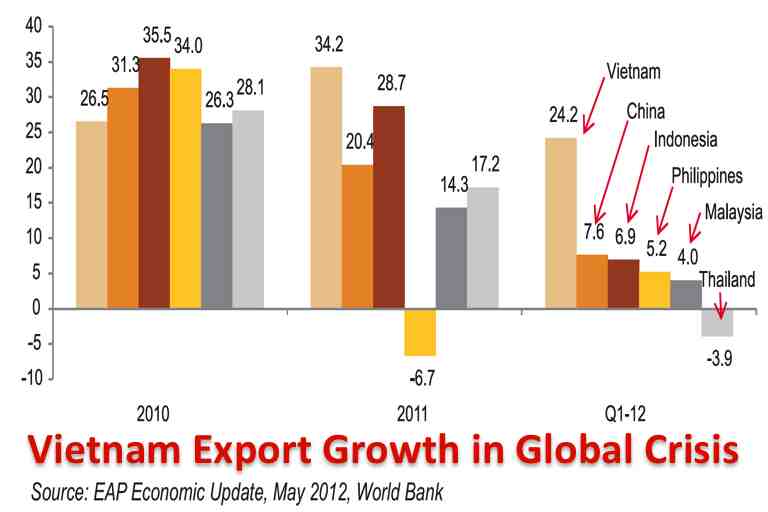

While many people talk a lot about the massive success of China, Indonesia, Phillipines and Asia, in exporting to developed nations, the truth is more complex and somewhat surprising.

While many people talk a lot about the massive success of China, Indonesia, Phillipines and Asia, in exporting to developed nations, the truth is more complex and somewhat surprising.

A growing proportion of this export growth is to other emerging nations rather than to the developed world. As the graph shows, despite the huge economic downturn in developed nations, and rapid slowing of growth across Asia, Vietnam has outshone its neighbours in 2011 and 2012, with every prospect of continuing to do so. In 2011, exports from Vietnam increased by over 34%, and 24% in 2012. There are a number of reasons for this.

Why migration to cities is so vital to China - economic growth. Future of China, demographic trends in Asia. Impact on regional economic growth. Long term outlook for China economy. Futurist Keynote Speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

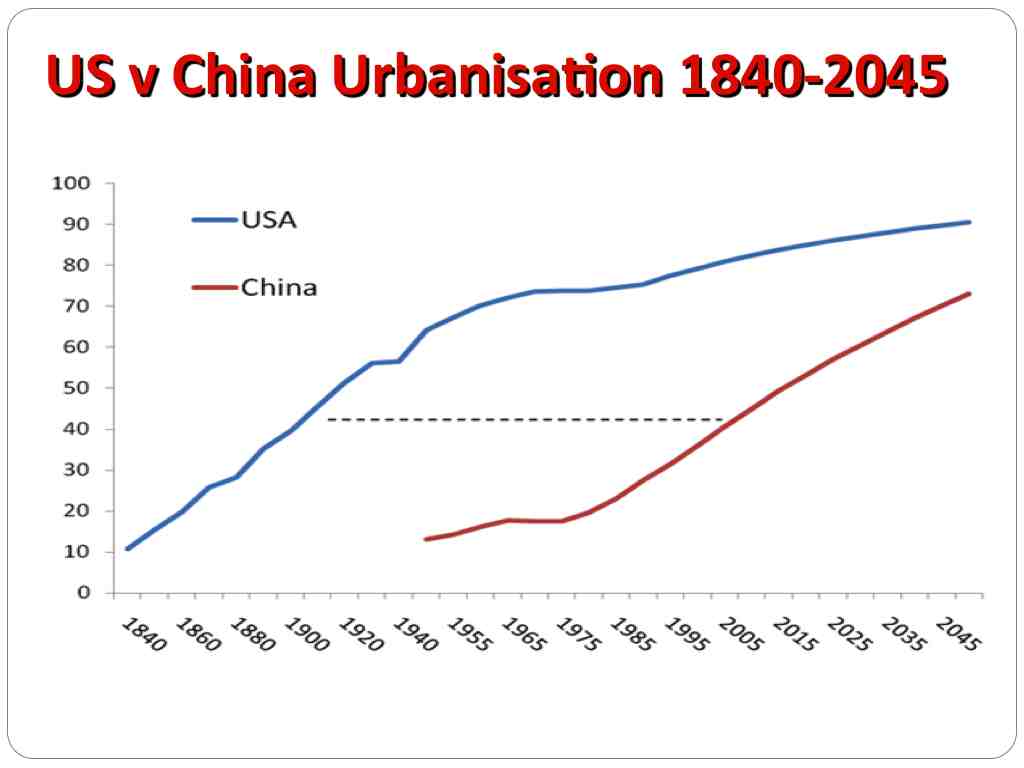

The Chinese government is planning for up to 300 million people to move to cities in the next decade. This huge migration will place immense strain on infrastructure and housing, as well as on job creation. These people are moving for a better life, in hope of higher incomes and opportunity. The risk is social unrest if economic development fails to keep pace with expectations.Why mass migration to cities will continue in China for 40 years.

Future of ASEAN - Asian equivalent of EU - Expect big job changes in 2015

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

600 million people, 8.8% of the world's population, live in nations which are part of the ASEAN community. If ASEAN were a single nation, it would rank be the 9th largest economy in the world. A key part of ASEAN 2015 is a proposal that people with skills should be able to move freely from one nation to another without need for work permits or special visas. This is a huge step which could have a huge impact on nations losing or gaining large numbers of skilled workers. Take the UK, which expected around 5,000 new migrant workers to enter the country each year following 10 new countries joining the EU. The reality was that over a million people arrived from Poland alone during the first three years.

Read more: Future of ASEAN - Asian equivalent of EU - Expect big job changes in 2015

How street traders drive economic growth in emerging markets

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

It is easy for governments in emerging nations to focus policy on helping or attracting big business, but small family-owned businesses are usually the greatest creator of new jobs, partly because there are so many of them. If a million businesses with an average of 10 employees, each manage to employ an average of just one extra person each, that’s a million new jobs. But most of these businesses will have started out informally and very small. Lessons from informal street-traders in India and Vietnam.

Read more: How street traders drive economic growth in emerging markets

Future of Vietnam - economy, banking, manufacturing, digital, green tech. Futurist keynote speaker on Emerging Markets such as Vietnam / Asia region

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Futurist keynote speaker: Vietnam's future will be driven by key trends such as economy, technology, demographics, mobile digital and retail banking. One in four of the population of Vietnam is under 14, median age of only 27, with a literacy rate of 94%. Labour costs in many parts of the country are only half those of China and Thailand. Wage inflation in China’s coastal cities is averaging around 12% a year, which will encourage more factories to relocate. Chinese wage inflation for most experienced managers can be as much as 100% a year. Vietnam will therefore continue to attract major manufacturing investment, and has a great future.Future of Singapore as hub for Asia's emerging markets - Future of Asia and Decline of Europe / America . Futurist Keynote Speaker

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Singapore along with the rest of the region has continued to enjoy strong economic growth, despite the obsession of Europe and America with a so-called global economic meltdown. Singapore is a natural hub for the region.It boasts the biggest and busiest port in the world, a huge airport, highly skilled workers, superb infrastructure and world-beating digital networks. Singapore business district contains regional headquarters of many of the largest multinationals, with specialty areas in banking, IT, telecom and international trade.

Video made in 2011 - very accurate.

1 billion new city dwellers - new markets, property, commodities, marketing

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Rapid growth of megacities -- impact on commodity prices, infrastructure building projects, multinational investment and real estate development. Impact on national economy.Demographic pressures ageing population and pressure on housing, future real estate trends and demand for different kinds of property. Urbanisation data in China, Africa, India and other parts of the world - economic growth.

Demographic graphs and tables for Australia showing...

Read more: 1 billion new city dwellers - new markets, property, commodities, marketing

Future of Emerging Markets Business Trends

Futurist Keynote Speaker: Posts, Slides, Videos - Future of Emerging Markets - Keynote Speaker

Future trends and business success in emerging markets, especially India and China. Futurist. Rise of new multinationals, future of telecom, future of banking and financial services, future of insurance, future of aluminium, carbon black and other commodities, future of textiles, manufacturing. Future of retail industry in India and India retail chains.

New global giants. Rapid consolidation, mergers and acquisitions. Future of motivation, war for talent, outsourcing, offshoring and winning the war for talent.

Work-life balance, making a difference, corporate and social responsibility, (CSR), community ...

More Articles...

- The Future of Outsourcing in world beyond ...

- Rural India: impact of urban migration ...

- Emerging markets: BRICS impact on developed world. ...

- Future of Panama - Economic Growth and Outlook

- Insurance market in India - expect rapid growth

- Retail Revolution in India

- Bottom of the Pyramid - Mobile Phone ...

- Future of Malaysia - Economic Growth from ...

- Future of Russia and former Soviet Bloc ...

- Future of Ukraine - Economic Outlook, Country Summary

- Panama Canal - impact on regional trade ...

- Future of Kazakhstan - Economic Outlook, Regional Significance

- Asian currency crisis: speed of globalisation

- Another Tsunami? Pictures, videos, facts, maps, tables

- Two thirds world debt

Page 1 of 2

Futurist Keynote Speaker - New

- TRUTH about US trade War - what next? Why markets and voters more powerful than any US President. How chaos will resolve and likely end result. Patrick Dixon is global keynote speaker on economy and geopolitics

- Truth about US trade chaos. How Tarrifs will settle and why. Power of global markets and megatrends greater than any President. Comment after keynote at Logistics World in Mexico

- How US trade tariff chaos will settle and why - impact on US economy, Mexico, Canada, EU and other regions. Comment after Mexico Keynote at Logistics World

- Beyond Chaos - how to survive and thrive. What next for global trade, tariffs, Russian war, other geopolitical risks and the global economy.

- How to give world-class presentations. Keys to great keynotes. How to communicate better and win audiences over. Expert coaching for CEOs, Executives, keynote speakers – via Zoom or face to face

- Future of the Auto Industry: Why Our World Needs Low Cost Chinese e-vehicles. Impact of China electric cars on US and EU auto industry. Sustainability and GreenTech innovation keynote speaker

- Daily Telegraph:"If you need to acquire instant AI mastery in time for your next board meeting, Dixon’s your man. Over two dozen chapters. Business types will enjoy Dixon's meticulous lists and his willingness to argue both sides." BUY AI BOOK NOW

- Interview: How AI Will Change Your Life - book author Patrick Dixon, keynote speaker on AI, in conversation with Alison Jones, Extraordinary Business Book Club. Looking for a keynote speaker on AI? BOOK AI Keynote NOW

- Impact of AI on $10tn PA food and beverage sales (F&B), fast moving consumer goods (FMCG). Why trust and emotion matter in an AI-influenced retail world. Extract Ch 16 - new book: How AI will Change Your Life - Patrick Dixon Futurist Keynote Speaker

- AI in Government. Impact of AI on state departments, AI efficiency, AI cost-saving. AI policy decisions and global regulation of AI. Extract from Chapter 26 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on insurance and AI

- AI warfare: AI in future conflicts. Battlefield AI, impact of AI on defence, military budgets, AI hybrid weapons, armed forces strategy. Extract from Ch25 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on Defence and AI

- AI will create HUGE new cybersecurity risks, hijacked by criminals and rogue states. Paralysis of companies, hospitals, governments. Extract from Chapter 23 - new book: How AI will Change Your Life - Patrick Dixon, keynote speaker - cybersecurity and AI

- AI for Insurance: how AI will impact AI in underwriting, quotes, re-insurance. AI will improve claims handling, AI reducing fraud. Extract from Chapter 22 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on insurance and AI

- How AI will impact banks: AI will save bank core costs, deliver better banking services, but AI will also create huge new banking risks. Extract from Chapter 22 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on banking and AI

- AI Investing, AI in Fund Management, Pension Funds, AI trading in Stock Markets and Global Financial Services AI, Banking AI. Extract from Chapter 21 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on Fund Management AI

- How AI will double digital energy consumption globally in 10 years. AI will have huge impact on energy, environment, sustainability. Extract from Chapter 20 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on sustainable AI

- AI in Construction - future Impact of AI on built environment. Buildings design, architecture, site development, AI in smart cities. Extract from Chapter 19 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI in construction

- Manufacturing AI. How AI will transform factories and manufacturing, including AI logistics and AI-driven supply chain management. Extract from Chapter 18 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI in manufacturing

- AI impact on travel, tourism AI, transport AI, auto industry AI, aviation AI, airlines. How AI will change the travel experience.Extract from Chapter 14 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI for travel industry

- Future of retail AI: impact on retail sales, retail marketing, customer choice, AI predicts demand, AI warehouse, AI supply chains.Extract from Chapter 13 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI retail trends

- Future Marketing: Impact of AI on Marketing - how AI will transform marketing, AI trends in advertising. Extract from Chapter 12 - new book: How AI will Change Your Life - by Patrick Dixon, keynote speaker on AI marketing

- Impact of AI on search engines, what AI means for news sites, AI in social media, AI in publishing and AI art copyright. Extract from Chapter 11 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Future of Music Industry: AI impact on music, musicians, record labels, AI composing, AI lyrics, AI copyright violations. AI for song-writers, singers, album producers.Extract book Ch10: How AI will change your life - Patrick Dixon Keynote Speaker

- Future Film, TV, Media, video games - impact of AI on film-making, AI movies, AI in studios, post-production AI, computer games. Extract from Ch10 new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on film industry, TV and media

- Impact of AI on software development, programming, high level coding, AI system design, and AI strategy. Extract from Chapter 9 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on software and IT strategy / design

- Impact of AI on adult education. Teaching entire nations how to tell what is true v fake news, AI scams or false consipiracy theories. Extract from Chapter 9 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on education

- Future of Education - Impact of AI on Teaching, Schools and Colleges. Why AI will force radical changes in teaching curriculum and methods. Extract from Chapter 7 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker on education

- Impact of AI on Pharma, Drug Discovery, Drug Development and Clinical Trials.10m lives Will Be Saved A Year Globally Because Of AI In Pharma and Health. Extract Ch 6 New Book: How AI Will Change Your Life - Dr Patrick Dixon, Pharma And AI Keynote Speaker

- How health care, hospitals and community care will be impacted by AI. 10 million lives will be saved a year globally because of AI in health. Extract from Chapter 5 - new book: How AI will Change Your Life - Dr Patrick Dixon, health and AI keynote speaker

- How will AI impact office workers, teams and working from home (WFH)? Lessons for every team leader, manager and leader on AI impact at work. Extract from Chapter 4 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Why AI will result in MORE JOBS. Myth of global job destruction from AI due to net job creation. How will AI impact the workplace and work itself? Extract from Chapter 3 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Super-Smart AI and a Reality Check. How Super-smart AI will become conscious, posing all kinds of new Super AI / AGI risks to future of humanity. Extract From Chapter 2 - New Book: How AI Will Change Your Life - by Patrick Dixon, AI keynote speaker

- The TRUTH about AI / Artificial Intelligence. What is REALLY happening and why this matters now for your personal life, job and wider world. Extract from Chapter 1 - new book: How AI will Change Your Life - by Patrick Dixon, AI keynote speaker

- Impact of AI on Health Care and Pharma – Artificial intelligence keynote outline for Pharma companies and health care organisations. How will AI drive future AI innovation in health and Pharma?

- How AI will change your life - my latest book, out NOW A Futurist's guide to a super-smart world. 28 chapters on impact of AI in industry, government, company, personal lives. Patrick Dixon is a world leading keynote speaker on AI. CALL +44 7768511390

- Risk of Russia war with NATO. Russia's past is key to it's military future. War and Russian economy, Russian foreign policy and political aspirations, future relationship between Russia, China, EU, NATO and America - geopolitical risks keynote speaker

- Over 2 million have watched my Green Energy Webinar! "Next 20 years will determine future of humanity": predictions for 40 years. Massive scaling green tech. Race for solar, wind v coal, oil, gas. Climate emergency. Futurist Keynote for Enel Green Power

- How AI / Artificial Intelligence will transform every industry and nation - banking, insurance, retail, manufacturing, travel and leisure, health care, marketing and so on - What AI thinks about the future of AI? Threats from AI? Keynote speaker

- The Future of AI keynote speaker. Will AI destroy the world? Truth about AI risks and benefits. (Some of this AI post written by AI ChatGPT - does it matter?). Impact of AI on security, privacy AI, defence AI, government AI - keynote speaker

- Future of Rail in 2030: trends in rail passengers, rail freight, railway innovation. High speed rail, impact on aviation. Rail logistics and supply chain management. AI impact, Zero carbon hydrogen powered railway locomotives - Rail Trends Keynote

- Future of the Auto Industry 2040. Trends impacting the auto industry, car manufacturers, truck factories. Auto industry innovation, autonomous vehicles, flying cars, vehicle ownership, car insurance AI / Artificial Intelligence.Futurist Keynote for Belron

- Future of Aviation: Carbon Zero Planes. New fuels such as hydrogen, smaller short distance battery powered vertical take-off vehicles. Why Sustainable Aviation Fuel is not the answer to global warming. 100s of innovations such as AI will impact aviation

- THE TRUTH ABOUT FUTURE MASS MIGRATION - a people movement with greater force than any military superpower. As I predicted in "Futurewise" (1998-2005), large scale migration is now unstoppable, able to break governments, yet many nations NEED migration

- Why MOST CEO SPEECHES don't create passion or purpose - just create Quiet Quitters. 270,000 views of this PURPOSE speech which no AI can deliver. For typical company in an industry often criticised. Reverse Great Resignation! Leadership Keynote Speaker

- The Future of Life Insurance. Why life insurance will boom globally. New pattens for selling life cover, AI automated underwriting , wearable devices, dynamic premiums. How life expectancy will change.How to build your brand.Life Insurance keynote speaker

Most Read - Futurist Speaker

- Futurist Speakers: How keynote by Patrick Dixon will transform your event. Visionary, high impact, high energy, entertaining Futurist keynotes on future trends. Keynotes on AI, tech, health, marketing, manufacturing etc. 370,000 reads. CALL +44 7768511390

- Conference Speakers: How Great Conference Speakers Change Lives. 10 tests BEFORE booking top conference speakers. Keys to world-class events. Secrets of ALL best keynote speakers. Who are best keynote speakers in world? 327,000 reads. CALL +44 7768511390

- Futurist Keynote Speaker Website - Sorry - something has gone wrong! We will check it out...

- Future of Marketing 2030 - Marketing Videos, key marketing trends and impact of AI on marketing campaigns. Conference Keynote Speaker on Marketing - 234,000 have read this post. Marketing Keynote Speaker: CALL NOW +44 7768 511390

- The Future of Outsourcing in world beyond AI - Impact on Jobs - Futurist keynote speaker on opportunities and risks from outsourcing / offshoring. Why many jobs coming home (reshoring - shorter supply chains). AI and new risk, higher agility. 200000 views

- Future of Stem Cell Research - Creating New organs and repairing old ones. Trends in Regenerative Medicine, anti-ageing research, AI. Future pharma, clinical trials, medical research, heath care trends, and biotech innovation.Health care keynote speaker

- Future of the European Union - Enlarged or Broken? What direction for the EU over the next two decades? Geopolitics keynote speaker

- The Truth About Drugs - free book by Dr Patrick Dixon - research on drug dependency, addiction and impact on society of illegal drugs

- Forecasts I made re Brexit were correct: short term and long term. Impact on your personal life, house prices, brexit business strategy, community, EU and wider world. Cut through toxic nonsense. Keynote speaker on geopolitics and economy

- 10 trends that will really DOMINATE our future - all predictable, changing slowly with huge future impact - based on book The Future of Almost Everything by world-renowned Futurist keynote speaker. Over 100,000 views of this post. Discover your future!

- Future of the Automotive Industry (Auto Trends) - e-cars, lorries, trucks and road transport trends, reducing CO2 emissions, e-cars, eVTOL flying vehicles, hydrogen, autonomous AI drivers, auto industry impact from AI. Futurist keynote speaker

- Marketing to Older Consumers - 1.4 billion over 60 year old consumers by 2030. Future of Marketing Keynote Speaker. Ageing customers, strategies to target older consumers and other marketing trends. Why many companies fail in marketing to older people

- Future of Aviation Industry. Rapid bounce back after COVID AS I PREDICTED. Most airlines and airports were unprepared for recovery. Aviation keynote Speaker. Fuel efficiency, reducing CO2, hydrogen fuel, AI, zero carbon, flying taxis (eVTOL)

- The Truth About Westminster

- The Truth about AIDS

- China as world's dominant superpower - Impact on America, Russia and EU. Futurist keynote speaker on global economy, emerging markets, geopolitics and major market trends

- Web Traffic: Up to 2.9 million pages a month - Future Trends website of Patrick Dixon, Futurist Keynote Speaker

- Futurist Keynote Speakers. 20 secrets of world's best keynote speakers. How to select great keynote speakers for your events. Secrets of all top keynote speakers. Change how people see, think, feel and behave. Who are the best? CALL +44 77678 511390

- Patrick Dixon Futurist Keynote Speaker - ranked one of top 20 most influential business thinkers, Chairman Global Change Ltd, Author 18 Futurist books. Call now to discuss a Transformational Futurist Keynote for Your Event: +44 7768 511390

- Total media audience >450 million on TV, Radio, Press Coverage of Patrick Dixon, Futurist Keynote Speaker - Call Patrick Dixon NOW for media interviews (or for event keynotes) on +44 7768 511390.